Retail Giant Captures Quarter of Food Aid Dollars While Underpaid Staff Depend on Taxpayer-Funded Benefits

New York, N.Y. — In the shadow of towering skyscrapers and bustling avenues, the stark realities of economic disparity play out far from the glamour. Here, amid debates over fiscal responsibility and social equity, Walmart emerges as a paradoxical force: a corporate colossus that funnels tens of billions of U.S. dollars in Supplemental Nutrition Assistance Program (SNAP) benefits into its coffers annually, even as its own workforce—numbering 1.6 million in the U.S.—relies heavily on the very program it helps sustain through unlivable wages.

This dual role, critics argue, exemplifies “corporate welfare,” where taxpayer dollars prop up private profits while perpetuating cycles of poverty. As federal proposals loom to slash SNAP funding by up to $230 billion over the next decade, the retailer’s influence—and its lobbying expenditures topping $7 million yearly—raises urgent questions about accountability in America’s social safety net.

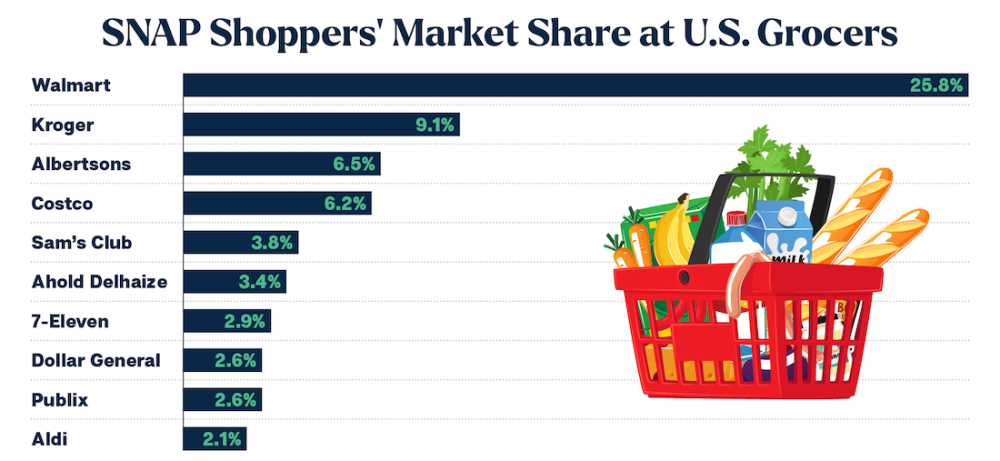

The story of Walmart and SNAP is not merely one of commerce but of systemic interdependence. In fiscal year 2024, the U.S. Department of Agriculture disbursed nearly $100 billion in SNAP benefits, aiding 41.7 million low-income individuals and families with monthly allotments averaging $209 per household member. Of that vast sum, Walmart captured approximately 25%, translating to roughly $25 billion in sales from EBT card swipes at its 4,600 U.S. stores. This dominance—far outpacing competitors like Kroger (8%) and Costco (6%)—underscores the retailer’s grip on the grocery landscape for vulnerable shoppers.

Yet, this influx comes at a hidden cost to the public purse. A 2020 Government Accountability Office (GAO) analysis revealed that more than half of adult SNAP recipients and 48% of Medicaid enrollees work full-time, often for large employers in retail and food services. Walmart, with its average hourly wage hovering at $18.25 in 2025, exemplifies this trend. For a single parent supporting a family of three, that equates to an annual income of about $37,440—barely 120% of the federal poverty level, rendering many eligible for SNAP despite steady employment. Recent disclosures indicate at least 14,500 Walmart associates in just nine states receive SNAP benefits, a figure that balloons when extrapolated nationwide.

The Corporate Windfall from Federal Food Aid

Walmart’s entanglement with SNAP traces back to the program’s expansion in the 1970s, but its scale has exploded in the digital age. With seamless EBT integration and ubiquitous locations, the retailer commands 94.3% of SNAP transactions among beneficiaries who shop there.

In the 12 months ending July 31, 2024, SNAP-funded grocery trips at Walmart accounted for 25.8% of all such expenditures, even as overall SNAP usage dipped to 3.7% of total grocery visits in 2025—a 19.6% decline from 2024.

This shift reflects post-pandemic adjustments: emergency allotments ended in March 2023, slashing benefits by 8.5% and prompting shoppers to seek value-driven alternatives.

For Walmart, however, the downturn is relative. The company’s fiscal 2025 revenue climbed 5% to $681 billion, buoyed by $19.4 billion in profits.

SNAP sales, though comprising just 3.7% of its total, represent a stable revenue stream immune to market whims.

Analysts note that as benefits wane, low-income consumers gravitate toward Walmart’s low prices, potentially offsetting losses elsewhere.

“SNAP shoppers are shifting to large-format retailers offering strong value,” observes a Numerator report, citing Walmart‘s assortment as a magnet for cash-strapped families.

This dynamic irks advocates for economic justice. Barry Ritholtz, a New York-based wealth manager, lambasts the arrangement as “socialized capitalism for corporations and no safety net for individuals.”

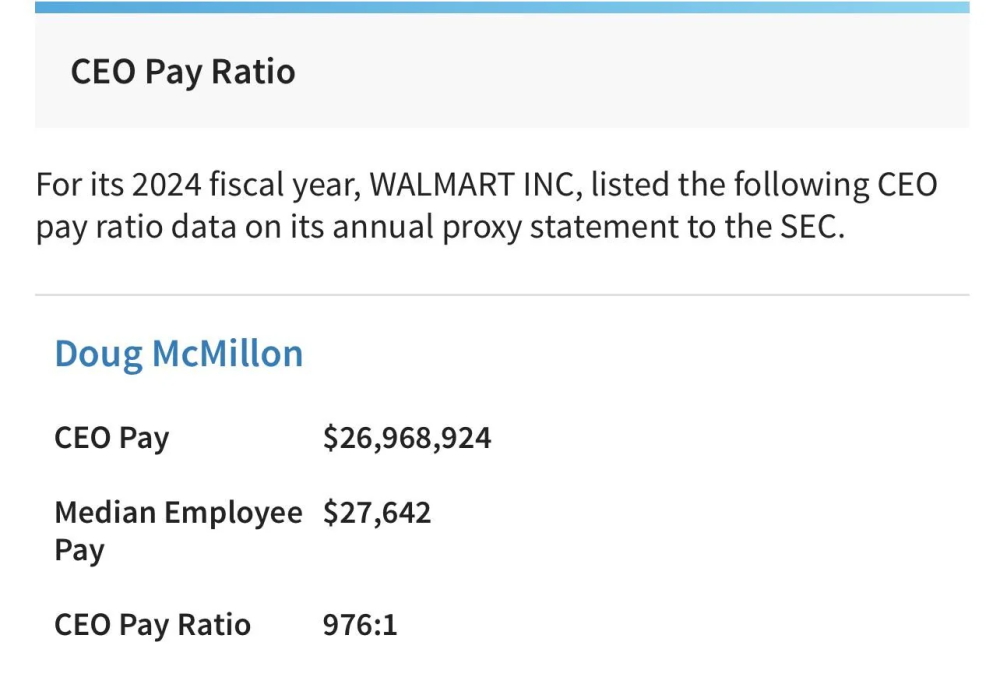

He argues that firms like Walmart—with a C.E.O.-to-worker pay ratio of 930 to 1 in 2024—externalize labor costs onto taxpayers, reaping billions while Congress debates cuts. In Nevada alone, Walmart ranked among the top employers for Medicaid claims in 2024, contributing to over $1.1 billion in state costs for workers at large firms.

Low Wages Fueling a Cycle of Dependency

At the heart of the paradox lies Walmart‘s compensation model. Despite raising its average minimum wage to $17.50 per hour in 2023 and $18.25 in 2025, the pay often falls short of living costs in many regions.

A full-time cashier in rural Arkansas, for instance, earns about $1,000 biweekly before taxes—insufficient for rent averaging $1,200 monthly, let alone groceries or childcare. The GAO’s 2020 findings confirm that 51% of SNAP households include working adults, with retail giants like Walmart overrepresented.

Historical data paints a grim picture. A 2014 study estimated Walmart’s low-wage workforce cost taxpayers $6.2 billion annually in SNAP, Medicaid, and housing subsidies—equivalent to one day’s company profits at the time.

Adjusted for inflation and enrollment growth, that figure likely exceeds $10 billion today, though spotty reporting obscures precision.

In nine states analyzed recently, 14,500 Walmart associates claimed SNAP, a tally that could scale to 50,000 nationwide given the company’s 1.6 million U.S. headcount.

Workers echo the strain. “You clock in for 40 hours and still qualify for full benefits because rent eats half your check,” shared one anonymous associate from Ohio via a labor forum, highlighting the precarity.

Another, a part-time stocker in Texas with two children, noted, “SNAP bridges the gap, but it’s humiliating to shop where you work knowing the company profits from it.” These testimonials align with broader surveys: 86% of SNAP users exhaust benefits before month’s end, forcing reliance on high-interest loans or food pantries.

Walmart defends its practices, touting investments in associate well-being, including $1 billion annually in training and health initiatives. Yet critics, including Sen. Bernie Sanders, decry it as a subsidy scam: “Taxpayers subsidize poverty wages at Walmart and McDonald’s, allowing executives to pocket billions while workers scrape by.”

Lobbying Muscle Safeguards the Status Quo

To entrench its advantages, Walmart deploys formidable lobbying resources. In 2024, the company spent $7.24 million on federal advocacy, targeting issues from trade tariffs to nutrition policy.

Through 2025, expenditures reached $4.6 million, with projections nearing $7 million by year-end—up slightly from $7.07 million in 2023.

This outlay, funneled via 40+ lobbyists and trade groups like the National Retail Federation, influences SNAP eligibility and state-level implementations.

Much of the effort counters reform. As House Republicans advanced a $230 billion SNAP trim in 2025—shifting costs to states and imposing work requirements—Walmart quietly supported measures preserving benefit flows to retailers.

Disclosures show advocacy on “nutrition assistance” and “workforce development,” euphemisms for staving off cuts that could dent its $25 billion SNAP haul. Broader political giving, exceeding $32 million since January 2023 by Walmart and the Walton family, amplifies this sway.

Ritholtz frames it bluntly: “If you’re the biggest beneficiary of food assistance, you’re not truly independent—you’re a ward of the state.” This lobbying, he contends, ensures low-wage models persist, with SNAP as the invisible backstop.

Voices from the Aisles: Human Cost of the Cycle

Beyond balance sheets, the interplay exacts a human toll. In Chicago’s South Side, Maria López, a 12-year Walmart veteran earning $17.80 hourly, supplements her $1,850 monthly take-home with $300 in SNAP for her family of four. “I stock the shelves with the food I can’t always afford,” López says, her voice steady but edged with fatigue. “The company says we’re family, but when benefits run out mid-month, it’s clear who’s really carrying the load.”

Similar stories ripple nationwide. In Nevada, where Walmart topped Medicaid employer lists from 2017 to 2019, associates report skipping meals to stretch allotments. A GAO survey found 20% of SNAP-enrolled workers from top firms like Walmart in some states, underscoring the breadth. As cuts loom—effective November 2025, with stricter work rules and immigration checks—experts warn of deepened food insecurity.

Toward Accountability: Breaking the Subsidy Loop

Reformers call for wage mandates and transparency. Proposals include tying federal contracts to living-wage standards (at least $15 per hour in high-cost areas, or 150% of local minimums) and requiring disclosures of assistance costs per employer. Walmart has pledged further raises, targeting $19 by 2026, but skeptics demand more: profit-sharing or universal basic income pilots to sever the dependency.

As October 28, 2025, unfolds, the debate intensifies. Walmart‘s SNAP symbiosis—gaining billions while fostering recipients—mirrors broader inequities. Without intervention, the cycle endures: low pay begets aid, aid begets sales, and sales fund the lobbying that sustains it all. In a nation of abundance, ensuring dignity for workers demands more than charity; it requires restructuring the very foundations of retail power.

Walmart’s SNAP Paradox: Billions Gained, Workers Subsidized (Oct. 28, 2025)

Summary

In this feature, Walmart captures 25% of $100 billion in SNAP sales—$25 billion—while its 1.6 million U.S. workers, paid $18.25 hourly on average, rely on the program amid poverty wages. Lobbying $7 million yearly protects this “corporate welfare.” Critics decry the hypocrisy as cuts loom, urging living wages to break the taxpayer-subsidized cycle. Voices from associates highlight the human strain in America’s retail underbelly. (72 words)

#WalmartSNAP #CorporateWelfare #LowWageEconomy #FoodInsecurity #LobbyingInfluence

TAGS: Walmart, SNAP, corporate subsidies, low wages, lobbying, poverty wages, food assistance, retail inequality

Facebook Post: Did you know Walmart pockets $25 billion yearly from SNAP benefits—the food aid its underpaid workers rely on to survive? This feature exposes the cycle: low wages create dependency, taxpayers foot the bill, and millions in lobbying keep it spinning. Time for living wages and accountability. Read more: [link to story] #WalmartSNAP #CorporateWelfare

Instagram Post: Walmart’s hidden subsidy: 25% of all SNAP dollars flow to its stores, while 1.6M U.S. associates earn wages that qualify them for the same aid. A $7M lobbying machine safeguards the status quo. Swipe up for the full story on this economic paradox. [Image: Infographic of SNAP cycle]

LinkedIn Post: As fiscal debates rage, consider Walmart’s role in SNAP: capturing $25B in benefits annually while its workforce depends on them due to sub-living wages. With $7M in 2024 lobbying, this “corporate welfare” demands scrutiny. Our feature explores data, voices, and reform paths. What’s your take on tying aid to wage standards? [Link to story]

X / Twitter Post: Walmart: $25B from SNAP sales, but low wages ($18.25/hr avg) force workers onto the program. $7M lobbying protects it. Corporate welfare at its finest. Full feature: [link] #WalmartSNAP #LowWages

BlueSky Post: Unpacking Walmart’s SNAP double-dip: Billions in benefits in, underpaid staff out—creating more recipients. Lobbying millions ensure the loop. Thoughtful read on inequality’s retail face. [Link to story] #CorporateWelfare #SNAPReform