Times of India projects the bill’s ambitious tax cuts and increased defense spending will add $3.4 trillion to the federal deficit by 2034, pushing the national debt to a staggering 130% of GDP. The Stewardship Report notes this amount would take over 9,000 years to spend if $1 million spent each and every day; that’s longer than recorded human history.

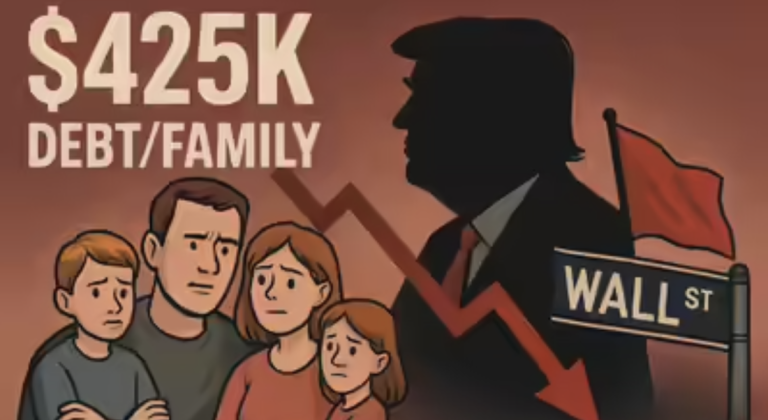

New York, N.Y. – A sweeping new legislative proposal championed by President Donald Trump, dubbed the “One Big Beautiful Bill Act,” has sparked alarm on Wall Street and among economic analysts, with warnings that it could plunge the U.S. into a deeper debt crisis.

According to a report by the Times of India, the bill’s ambitious tax cuts and increased defense spending are projected to add $3.4 trillion to the federal deficit by 2034, pushing the national debt to a staggering 130% of GDP. Experts, including Ray Dalio, founder of Bridgewater Associates, caution that this trajectory could destabilize credit markets and trigger severe economic disruptions.

The Stewardship Report notes that, as usual,

“The Rich Get Richer, While the Poor Get Poorer.”

The Congressional Budget Office (CBO) estimates that the bill, which includes $4.5 trillion in tax cuts and significant defense spending, could balloon interest payments to $2 trillion annually. This financial strain, analysts warn, might force a combination of inflation, tax hikes, and spending cuts that could cripple the U.S. economy.

Ray Dalio, a prominent hedge fund manager, emphasized the gravity of the situation, stating, “Unless this path is soon rectified… big, painful disruptions will likely occur.” His concerns highlight the risk of eroding investor confidence, which could further destabilize global financial markets.

The legislation seeks to make permanent the tax cuts from Trump’s 2017 Tax Cuts and Jobs Act, alongside new provisions like exemptions on taxes for tips, overtime, and certain auto loan interest. While these measures aim to provide relief to American households, critics argue they disproportionately benefit high-income earners.

The Tax Policy Center notes that those earning $217,000 or more annually would see the largest tax breaks, while low-income groups may face reduced benefits due to cuts in social programs.

Debt Spiral Raises Red Flags

The CBO projects that the bill will increase the national debt by $2.4 trillion over the next decade, a figure that has drawn sharp criticism from Democrats and some Republicans. Rep. Brendan Boyle, a leading Democrat on the House Budget Committee, called the bill a “disgusting abomination,” pointing to the hypocrisy of Republicans who, he claims, lament debt under Democratic administrations but expand it when in power. The proposed $4 trillion increase to the U.S. debt ceiling, currently at $36 trillion, underscores the bill’s potential to exacerbate the nation’s fiscal challenges.

Wall Street has already felt the tremors. The S&P 500 and Dow Jones Industrial Average experienced volatility following the House of Representatives’ narrow approval of the bill by a 215–214 vote. Rising Treasury yields, with the 10-year note climbing to 4.63% before settling at 4.59%, reflect investor unease about the growing debt load. Ipek Ozkardeskaya, an analyst at Swissquote Bank, noted that the spike in yields signals “a lack of confidence in the U.S. government and its policy direction.”

Energy Policy Sparks Global Concerns

Beyond fiscal implications, the bill’s energy policies have raised eyebrows. By phasing out clean energy tax credits introduced under President Joe Biden, the legislation could hinder America’s renewable energy sector.

Thomas Friedman, writing for the New York Times, sarcastically suggested that China might celebrate July 4 as “American Electricity Dependence Day” due to the bill’s favoring of fossil fuels. China, by contrast, has surged ahead in renewable energy, generating over 10,000 terawatt-hours of electricity, largely from wind, solar, and hydro, while the U.S. lags with modest gains.

This shift could weaken America’s strategic position in the global energy market. Saudi Arabia and other fossil-fuel giants are investing heavily in green energy to power AI data centers, aligning with global trends toward sustainability.

The bill’s rollback of clean energy initiatives risks ceding technological and economic advantages to competitors like China, which Friedman describes as an “electrostate” resilient to trade wars and geopolitical shocks.

Social and Immigration Impacts

The One Big Beautiful Bill Act also includes contentious provisions on immigration and social programs. It allocates $46.5 billion to resume construction of the U.S.-Mexico border wall, aiming to complete 700 miles of primary barriers.

Additionally, the bill introduces stricter work requirements for Medicaid and SNAP recipients up to age 65, potentially reducing benefits for millions. The CBO estimates that 10.9 million people, including 1.4 million undocumented immigrants, could lose health insurance by 2034 due to these changes.

These measures have drawn fierce opposition. Democrats argue that the bill prioritizes border security and tax cuts for the wealthy over the needs of vulnerable populations. The proposed $500 boost to the child tax credit and a temporary $2,000 increase in the standard deduction for joint filers offer some relief, but analysts warn these benefits may be overshadowed by the broader economic fallout.

What’s Next for the Bill?

As the bill moves to the Senate, significant revisions are expected. Republican unity is fraying, with five members voting against an earlier version that included MAGA accounts offering $1,000 for newborns, signaling potential hurdles. Wall Street analysts and economists urge lawmakers to address the bill’s fiscal risks before it reaches President Trump’s desk.

The Times of India report underscores the global stakes, noting that the legislation could reshape U.S. economic policy and its standing in international markets.

The debate over the One Big Beautiful Bill Act reflects deeper tensions about America’s economic future. Will the U.S. prioritize short-term tax relief or long-term fiscal stability? As Ray Dalio warns, the path forward could lead to “big, painful disruptions” if left unchecked.